The size of the worldwide 3D printing market was estimated at USD 13.84 billion in 2021, and it is anticipated to increase at a CAGR of 20.8% from 2022 to 2030. Global shipments of 3D printers reached 2.2 million units in 2021, and by 2030, 21.5 million units are anticipated to be shipped. The market is anticipated to increase as a result of the aggressive three-dimensional printing research and development as well as the rising demand for prototype applications from different industrial verticals, particularly healthcare, automotive, and aerospace and military.

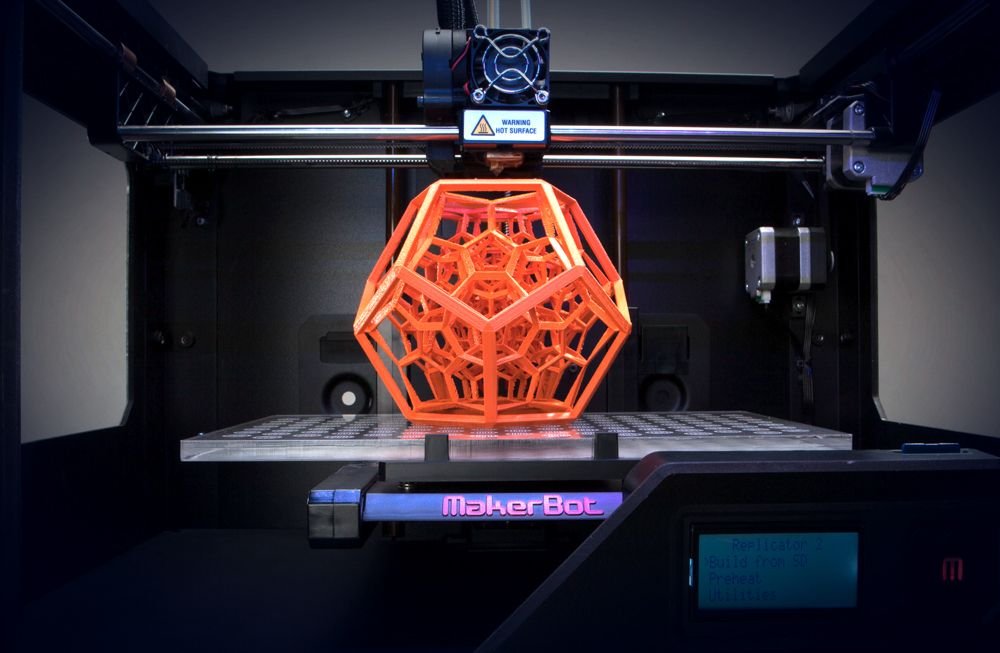

The term “additive manufacturing” is frequently used to describe the use of 3D printing in industrial uses (AM). With the aid of software and a 3-dimensional printer, additive manufacturing involves adding material layer by layer to create an object from a three-dimensional file. To carry out the process, a pertinent 3D printing technology is chosen from the pool of options. The final step entails implementing this procedure across many industry verticals as necessary.

The deployment comprises resolving copyright, licencing, and patenting-related issues as well as supplying installation services, consultation solutions, and customer support. In terms of prototyping, designing the structure and final goods, modelling, and speed to market, 3D printing is advantageous for manufacturers. Because of the significant decrease in production costs, firms are now able to sell superior items for less money. These advantages are anticipated to increase the demand for 3D printers in the upcoming years.

However, the adoption of additive manufacturing is being hampered by the widespread misunderstandings small and medium-sized firms have about the prototype procedures. Instead of attempting to comprehend the advantages and benefits of prototyping, businesses engaged in design, particularly small and medium-sized businesses, are hesitating before considering expenditures in prototyping as responsible investments. These businesses generally hold the belief that prototype is only an expensive step before manufacturing. Such misconceptions about prototype, in addition to a lack of technical expertise and an impending lack of standardized process controls, are anticipated to restrain industry expansion.

Covid-19 Impact on the Market

The COVID-19 pandemic outbreak has had a major effect on the global economy as a whole and, consequently, the 3D printing sector. In the beginning, Europe and Asia-Pacific were some of the areas with the greatest COVID-19 patient populations worldwide. Additionally, things became worse over in the United States. The governments issued an order for the total lockdown of some important cities due to the virus’ quick spread. The whole lockout has an impact on 3D printing industry production. The nation’s logistics and supply chain have been completely disrupted, which is blamed for this along with the labor deficit. The suspension of 3D printing output had a negative effect on the market’s overall growth in the first and second quarters of 2020.

Scope of the Report

In addition to providing an analysis of the most recent market trends and prospects in each of the sub-segments from 2017 to 2030, the research projects revenue growth at the global, regional, and national levels. The paper also includes shipment predictions and estimates, as well as qualitative ASP analysis from 2017 through 2030. Grand View Research has divided the worldwide 3D printing market research into segments for the purposes of this study based on component, printer type, technology, software, application, vertical, material, and region:

- Component Outlook (Revenue, USD Million, 2017 – 2030)

- Hardware

- Software

- Services

- Printer Type Outlook (Revenue, USD Million, 2017 – 2030)

- Desktop 3D Printer

- Industrial 3D Printer

- Technology Outlook (Revenue, USD Million, 2017 – 2030)

- Stereolithography

- Fuse Deposition Modeling

- Selective Laser Sintering

- Direct Metal Laser Sintering

- Polyjet Printing

- Inkjet Printing

- Electron Beam Melting

- Laser Metal Deposition

- Digital Light Processing

- Laminated Object Manufacturing

- Others

- Software Outlook (Revenue, USD Million, 2017 – 2030)

- Design Software

- Inspection Software

- Printer Software

- Scanning Software

- Application Outlook (Revenue, USD Million, 2017 – 2030)

- Prototyping

- Tooling

- Functional Parts

- Vertical Outlook (Revenue, USD Million, 2017 – 2030)

- Industrial 3D Printing

- Automotive

- Aerospace & Defense

- Healthcare

- Consumer Electronics

- Industrial

- Power & Energy

- Others

- Desktop 3D Printing

- Educational Purpose

- Fashion & Jewelry

- Objects

- Dental

- Food

- Others

- Material Outlook (Revenue, USD Million, 2017 – 2030)

- Polymer

- Metal

- Ceramic

- Regional Outlook (Revenue, USD Million, 2017 – 2030

- North America

- U.S.

- Canada

- Mexico

- Europe

- U.K.

- Germany

- France

- Italy

- Spain

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- South America

- Brazil

- Middle East & Africa

Segment Analysis

Printer Type Insights

In 2021, the industrial printer sector dominated the market and generated more than 70.0% of total revenue. The market has been further divided into industrial and desktop 3D printers based on printer type. The widespread use of industrial printers in heavy industries including automotive, electronics, aerospace and defense, and healthcare can be blamed for the significant market share of industrial 3D printers. Some of the most popular industrial applications across these industry verticals include prototyping, designing, and tooling.

The widespread use of 3D printing for tooling, designing, and prototyping is a factor in the industrial sector’s rising demand. Therefore, it is anticipated that the industrial printers category will maintain its dominance during the projection period. At first, only enthusiasts and tiny businesses used desktop 3-dimensional printers. However, they are now extensively employed for domestic and household needs. Desktop printers are also being used in the education sector, which includes universities, educational institutions, and schools, for technical training and research.

Particularly small firms are adopting desktop printers and expanding their product offerings to include 3D printing and related services. For instance, the idea of “fabshops” is becoming more popular in the United States. These fabshops provide 3D printing of parts and components on demand based on the specifications and designs supplied by the customers. Therefore, it is anticipated that during the forecast period, demand for desktop printers will increase significantly.

Technology Insights

In 2021, the market’s largest segment—stereo lithography—was responsible for more than 8.0% of worldwide sales. The segmentation has been done based on technology and includes stereolithography, fuse deposition modelling (FDM), direct metal laser sintering (DMLS), selective laser sintering (SLS), inkjet, polyjet, laser metal deposition, electron beam melting (EBM), digital light processing, laminated object manufacturing, and others.

One of the earliest and most widely used printing technologies is stereo lithography. Although stereo lithography technology has advantages and is simple to use, other effective and dependable technologies are now becoming more accessible thanks to technological advancements and vigorous research and development efforts on the part of industry experts and researchers.

Due to the widespread implementation of the technology across numerous 3DP processes, Fused Deposition Modeling (FDM) accounted for a sizeable revenue share in 2021. Due to the fact that these technologies can be used in specialised additive manufacturing processes, the DLP, EBM, inkjet printing, and DMLS segments are anticipated to see a rise in acceptance throughout the projection period. Opportunities for the implementation of these technologies would be made possible by the rising demand from the aerospace and defense, healthcare, and automotive verticals.

Software Insights

In 2021, the design software market was in first place and contributed more than 30% of worldwide revenue. Throughout the length of the forecast, it is anticipated to keep ruling the market. The 3DP industry has been divided into design software, inspection software, printer software, and scanning software based on the type of software used. Particularly in the automotive, aerospace and military, construction and engineering verticals, design software is utilised to create the designs of the thing to be printed. The hardware of the printer is connected to the objects that will be printed via design software.

The growing practice of scanning items and saving scanned papers is expected to increase demand for scanning software. During the forecast period, the scanning software segment is anticipated to be driven by the ability to retain the scanned images of objects, regardless of their size or dimensions, for 3-dimensional printing of these products as needed. In accordance with the increasing deployment of scanners, the scanning software segment is anticipated to develop at the highest CAGR of 21.7% from 2022 to 2030 and produce significant revenues.

Application Insights

In 2021, the prototyping market segment held the top spot and accounted for more than 55.0% of worldwide revenue. The industry has been further divided into prototype, tooling, and functional components based on application. This is explained by the widespread use of the prototype process in several industry sectors. Prototyping is used extensively in the automotive, aerospace, and defense industries to precisely design and build parts, components, and complex systems.

Manufacturers can build trustworthy final goods and attain improved precision through prototyping. Therefore, it is anticipated that the prototyping category would continue to rule the market during the projection period. Smaller joints and other metallic hardware connecting elements are examples of functional pieces. While developing machinery and systems, accuracy and accurate sizing of these functional pieces are of the utmost importance. The market for functional components is anticipated to grow at a sizable CAGR of 21.4% between 2022 and 2030 in line with the rising demand for functional parts in both design and construction.

Vertical Insights

In 2021, the automotive sector dominated the market and accounted for more than 20.0% of worldwide revenue. The market has been divided into distinct verticals for desktop and industrial 3D printing based on vertical. The verticals taken into account for desktop 3DP include things like dental care, cuisine, fashion and jewellery, and others. Automobile, aerospace and defense, healthcare, consumer electronics, industrial, power and energy, and other sectors are among those taken into account for the industrial 3DP.

Due to their active adoption of technology across a range of production processes, the aerospace and defense, healthcare, and automotive verticals are expected to significantly contribute to the growth of industrial additive manufacturing throughout the projected period. In the healthcare industry, AM contributes to the creation of synthetic muscles and tissues that resemble real human tissues and can be utilized in replacement surgery. These capabilities are anticipated to considerably contribute to the growth of the industrial industry and drive the use of 3DP across the healthcare vertical.

During the forecast period, it is predicted that the food, fashion and jewellery, and dental verticals would have a substantial impact on the growth of the desktop 3DP segment. In 2021, the dentistry vertical dominated the market, and it is anticipated that it will do so again over the projected period. A growing trend is the use of 3D printing to create replica jewellery, dollhouse miniatures, art and craft projects, and clothing and fashion.

Material Insights

In 2021, the metal category dominated the 3D printing market and accounted for more than 50.0% of worldwide sales. Additionally, it is estimated that the metal category would continue to lead during the forecast period and expand at the greatest CAGR. The sector has been further divided into polymer, metal, and ceramic segments based on material.

In terms of revenue share in 2021, the polymer segment came in second. The ceramic material market is anticipated to expand significantly during the coming years. Given that ceramic additive manufacturing is still relatively new, the demand for ceramic AM has increased as a result of increased R&D for 3DP technologies like FDM and inkjet printing.

Component Insights

In 2021, the hardware sector dominated the market and accounted for more than 60.0% of total revenue. The demand for sophisticated production techniques and rapid prototyping has greatly benefited the hardware industry. The expansion of the hardware market is mostly credited to a number of factors, including quick industrialization, rising consumer electronics penetration, improving civil infrastructure, quick urbanization, and reduced labor costs.

The industry has been further divided into hardware, software, and services on the basis of components. By printer type, technology, applications, vertical, and material, the 3DP hardware component market has been divided. Software type and printer type are additional categories for the software market. Only the type of printer is used to divide the services section. During the period of forecasting, the software component segment is anticipated to experience significant growth.

Regional Insights

In 2021, North America dominated the market and generated more than 30.0% of global revenue. This is a result of additive manufacturing being widely used in the area. The U.S. and Canada are two examples of North American nations that were among the leading and early users of these technologies in a variety of manufacturing processes. Given its size in terms of geography, Europe is the largest continent. It is home to a number of industry participants in additive manufacturing that have extensive technical knowledge of the procedures. So, in 2021, the European market grew to become the second-largest regional market.

The highest CAGR is anticipated for the Asia Pacific area during the forecast period. The advancements made in the region’s manufacturing sector have contributed to the rapid adoption of AM in Asia Pacific. Additionally developing as a manufacturing powerhouse for the healthcare and automotive sectors is the Asia Pacific area. Rapid urbanization and a dominance on consumer electronics manufacturing are other factors boosting three-dimensional printing demand in the area.

Key Companies & Market Share Insights

In response to the rising demand for 3D printing applications from the automotive, healthcare, aerospace, and defense sectors for manufacturing purposes, industry players are consistently improving the technology. The leading companies are spotting opportunities for business transformation through the use of additive manufacturing into the procedures for developing new products.

Market leaders like Stratasys Ltd. are extending the use of 3D printing beyond prototype to include the agility it can provide to the entire manufacturing value chain. The business can swiftly and affordably manufacture big end-use parts utilizing additive manufacturing thanks to their inventive line of 3D printers that uses Fused Deposition Modelling (FDM) and Selective Absorption Fusion (SAF) technologies. The following companies are well-known ones in the worldwide 3D printing market:

- Stratasys, Ltd.

- Materialise

- EnvisionTec, Inc.

- 3D Systems, Inc.

- GE Additive

- Autodesk Inc.

- Made In Space

- Canon Inc.

- Voxeljet AG